Is it time you enhanced your financial options and opportunities?

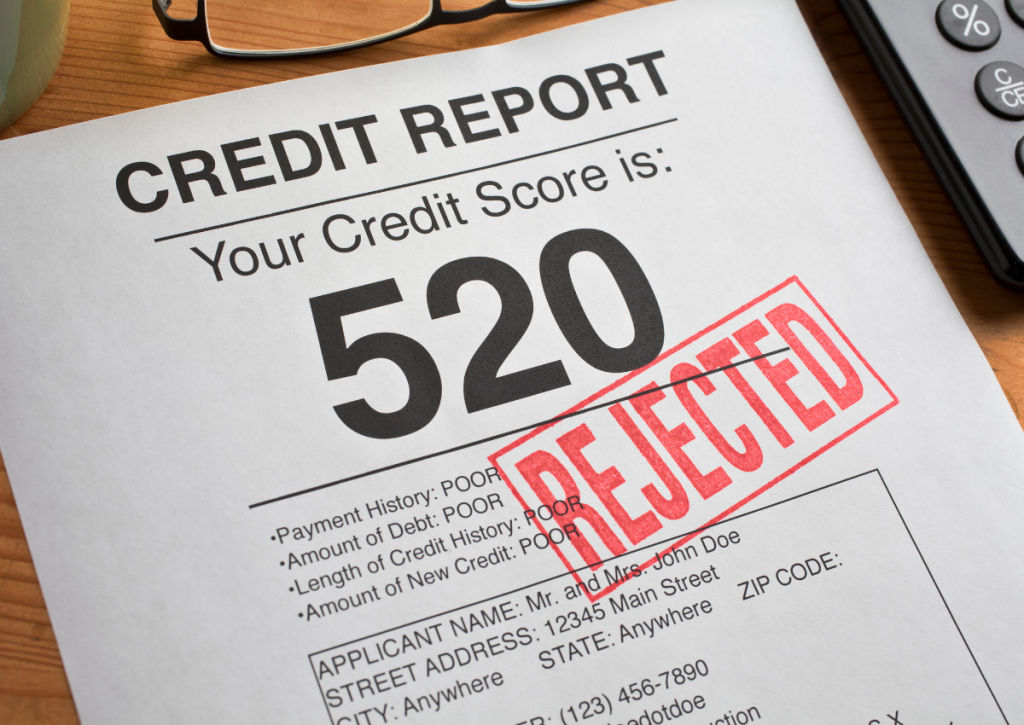

In Australia, credit scores are evaluated by Experian and Equifax. Negative financial histories like late payments, defaults, and bankruptcy can impact your credit file for several years. A bad credit rating can significantly hinder your ability to secure loans or credit, leading to higher interest rates and fees.

Credit Scoring Range

Credit ratings are scored ranging from "Excellent" to "Weak/Below average" based on financial history.

Up to 7 years on credit file

Negative financial histories such as late payments, defaults, and bankruptcies can impact your credit report for up to seven years.

Financial Prudence

While debit or prepaid cards and specialized loans are available, and improving your credit score involves timely payments and prudent financial management.

The enlarging options for people’s financial power extends to a wide array of options when it comes to gaining access to immediate necessity such as applying for a credit in return of a legal agreement to pay later. The advantages of applying for a credit account is a promising value towards convenience, a period of interest-free days, credit card rewards & insurance, and a whole lot more.

Getting knowledgeable on credit ratings’ financial requirements, its consequences in terms of bad scoring, and knowing bad credit ratings’ legal implications as early as now may be beneficial to you more than you think.

Credit bureaus essentially check on your credit ratings when you decide to apply for home loan, credit cards or personal loan. All of your financial history goes under the credit report and is being utilised to calculate your ability to pay on time, which then reflects as your credit score.

A bad credit rating can lead to higher loan costs and impact your ability to get credit, but alternative options like debit and prepaid cards remain available.

Improving your credit score involves timely payments, reducing debt, and managing finances prudently, which can enhance your financial opportunities.

Australia uses both Experian and Equifax’s basis on credit score band to calculate the risk of borrowers:

Credit band

Experian

Equifax

Excellent

800 – 1,000

833 – 1,200

Very good

700 – 799

726 – 832

Good

625 – 699

622 – 725

Fair / average

550 – 624

510 – 621

Weak / below average

0 – 549

0 – 509

A bad credit score would instantly affect your high chances of getting an approval when applying for loans. Worse, you may start resorting to finances with higher interest rates and fees which could possibly sink you more into future arrears and debts.

What financial histories categorised as bad and how long will it stay on my credit file?

- Reflects on one’s inability to pay on time.

- Up to two years

- Credit providers can necessitate debt collectors if you weren’t able to comply within the 60 days of payment due date.

- Five years, or seven when creditor’s can’t contact you

- You and your creditors can enter into a binding agreement by which they allow you to pay them a certain amount of money over periodic course.

- At least five years

- A person’s legal declaration of his inability to pay debts

- At least five years from the date of declaration; OR two years when the bankruptcy finishes

- Makes an impression of you undergoing a financial stress.

- Your information used for applications reflect up to five years

- Five years

What are my options if I have a bad credit?

A bad credit rating doesn’t necessarily close all options from you. You can still choose from a lot of credit products with proper research and guidance from professionals.

Aside from rejected application for credit cards for instance, you can still opt for a debit card or a prepaid card. Debit card allows you to spend money that you only have; while a prepaid card allows you to only spend the pre-loaded fund.

There are a lot of Australian moneylenders who allows for home loan or investment loans for those who have bad credit ratings. Seek a home loan adviser or a mortgage broker to know your options.

Resorting to a short-term loan (pay day loan) on urgent situations may save you if you are having second thoughts on qualifying for a personal loan after a bad credit. One catch is the possibility of being charged with a higher interest rate.

How can I improve my credit score?

- Your ability to pay off loans and debts follows easily if you have immediate access to funds, savings, and multiple streams of earnings. So the best thing to put yourself in the best financial position is to have a steady source of income.

- Be consistent on meeting your payments on time.

- Pay off other loans and credits.

- Be careful when spending. Lenders also consider taking a look at your savings to make sure there is enough money in your account.